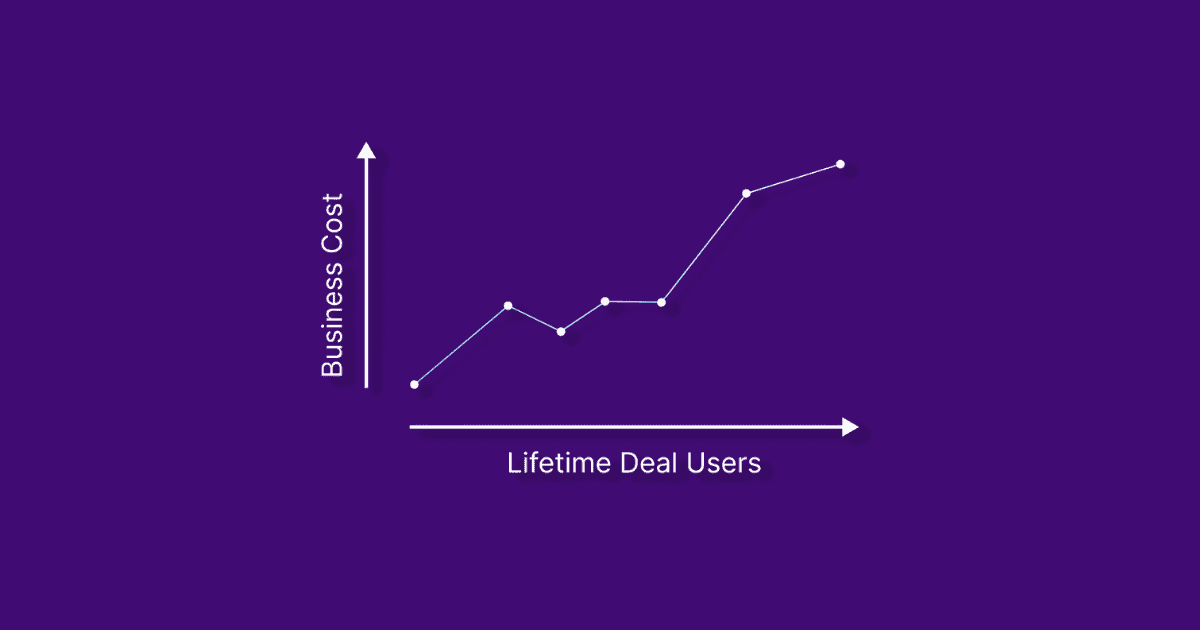

Could Running a Lifetime Deal Increase Your ongoing Business Costs?

Lifetime deals can provide a way to increase business revenue, but is it worth the cost?

We’ve all heard stories of how businesses cannot sustain the long-term costs associated with lifetime deals.

But could running a lifetime deal actually help you reduce your long-term costs and increase profitability?

Today we will take a closer look into if investing in lifetime deals can be truly beneficial in the long run for businesses looking for financial growth and stability.

Is spending more upfront ultimately worth it due to potential customer loyalty increases? Or does running these types of campaigns only pose additional overhead?

Let’s find out!

Could Running a Lifetime Deal Increase Your Ongoing Business Costs?

100% honesty. There is a chance, a higher chance that running a Lifetime Deal can increase your ongoing business costs.

There is no way SaaS founders or marketers can eliminate or avoid it.

But you can very well take proactive measures to minimize the cost impact and maximize the benefits from your Lifetime Deal Campaign.

For starters, it’s essential to understand the types of costs associated with running a lifetime deal. These costs can vary depending on the size and scope of your campaign, but they typically include one-time setup fees, recurring subscription fees, customer service and support fees, marketing costs, and any other miscellaneous expenses that may arise.

It’s also important to consider the potential upside of running a lifetime deal. Lifetime deals can provide businesses with long-term recurring revenue from customers who are more likely to remain loyal for a longer period of time. This can lead to reductions in customer acquisition costs and increased customer lifetime value.

Additionally, lifetime deals can provide the opportunity to reach new customers through word-of-mouth referrals.

Overall, running a Lifetime Deal campaign can be a great way to increase revenue and attract loyal customers. However, it’s important to consider all possible associated costs before making any final decisions.

Assessing The Potential Cost Increase from LTD

Assessing the potential increase in your business operating cost from a Lifetime Deal can help you understand what to expect and prepare for it.

From the experience of SaaS Mantra on running100s of Lifetime Deals over the years, we always recommend it to all our partners.

The Low-Cost Majority Lifetime Deal Users

We have seen, from our experience, that nearly 50% of the Lifetime Deal customers are not going to be using it much.

They are rather happy to get lifetime access to your product and add it to their tech stack.

The High-Cost Minority Lifetime Deal Users

On the other hand, 20% of the remaining 50% of Lifetime Deal customers are moderate users.

They are not going to increase your business costs much. However, they may cause you some overhead in the future.

Then there is the remaining 30% of LTD users who are going to be power users.

They are regular users of your tool. These customers can push your business costs significantly higher than the others. Still, these are also the customers who are going to engage with you more and give you more insights about your product with their unique use cases.

The Upside of the Power Users

Most of your user engagement during and after the lifetime deal is going to come from these power users.

They will be more than willing to share their use cases, give you feedback on the tool, and request additional features.

What Can You Do To Minimize The Potential Cost Increase?

You can take several measures to minimize the cost increase associated with Lifetime Deal users.

For example, you can set specific limits on the usage of features or the number of customers that can be onboarded with the Lifetime Deal.

You might also consider creating different tiers of lifetime deals to offer different levels of access and pricing. This way, you can ensure that only the most engaged and profitable customers are using your product.

It is important to successfully communicate the limitations on each tier of the deal so that you do not mislead your LTD buyers.

Finally, you should also take advantage of data to better understand the usage patterns of your Lifetime Deal customers. This knowledge will help you identify potential cost increases before they occur and take proactive steps to mitigate them.

Leverage the Momentum to Mitigate Business Costs

Ultimately, always treat your Lifetime Deal campaign more like a marketing channel, rather than a revenue-generating channel.

It will help you keep things in perspective and take informed decisions in terms of growing your business.

Utilize the power of the Lifetime Deal Community as a marketing channel. Be greedy in finding ways to develop your product into something more and bigger.

But you must remember to calculate your potential operating cost increase upfront before you run a lifetime deal.

Conclusion

Lifetime deals can be a great way to increase revenue and attract loyal customers. However, it is vital to assess the potential cost increases associated with running an LTD.

By understanding the different types of lifetime deal users and taking proactive steps such as setting usage limits and creating tiers of lifetime deals, businesses can minimize their costs while still leveraging the momentum of a successful campaign. Ultimately, it is important to remember that a lifetime deal should be viewed as a marketing channel, not just a revenue-generating channel.