What is Annual Contract Value (ACV)? Here’s How to Improve Yours!

A SaaS company has two types of contracts – the subscription model and the usage model. In the subscription model, customers pay annually for access to the service. On the other hand, the usage model allows customers to pay per use.

The annual contract value (ACV) is calculated using the average revenue per user (ARPU), churn rate, and growth rate.

Cloud computing has become very popular over the years because of its flexibility and low cost. However, cloud computing also comes with some risks.

One such risk is security threats, especially those involving data breaches. These risks are often overlooked, leading to higher costs for organizations that rely heavily on cloud computing.

(1) The ACV represents the total amount paid annually for each customer license.

This figure depends on a variety of factors, including the number of licenses sold, renewal rates, and the number of customers using cloud services. Some companies sell subscription licenses or perpetual licenses.

(2) Cloud service providers typically offer three types of pricing plans: Pay As You Go, Fixed Price, and Free Usage.

In general, fixed price plans tend to be less expensive due to their long-term contracts, whereas free usage plans usually require an upfront payment. The fixed price plan allows the organization to predict future expenses ahead of time. The free usage option offers unlimited access but requires the company to pay for the actual cloud resources used.

By understanding the factors that affect the ACV, you will be able to better manage your budget and maximize profits.

ACV vs ARPU

Annual Contract Value (ACV) is a metric used to measure the annual revenues generated by software applications sold under subscription models.

ACVs are calculated using two metrics: Average Revenue Per User (ARPU) and Total Number Of Users. The formula for calculating ACVs is given below: Annual Contract Value ARPU x Total Number Of Users.

The annual contract value (ACVs) is the total amount of revenue generated by a customer over a given period.

In other words, how much would you expect to earn from each customer per year? This metric helps determine whether a particular business model is sustainable and profitable.

To calculate ACVs, you’ll want to take into account several key elements, such as:

🔸Revenue (including recurring payments)

🔸Customer lifetime value (CLTV)

The term “average revenue per user” (ARPU) refers to the amount of money generated by each individual user of a service or application. In other words, ARPU measures the profitability of a company.

You should always aim to increase the ARPU (average revenue per user) but does this mean increasing the annual contract value or decreasing the number of contracts?

When you sign a deal with a customer, they pay you an agreed upon amount every month. This means that if you want to increase your ARPU, you’ll have to either decrease the number of customers you serve or increase their payment amounts.

Both options have pros and cons. If you lower your price point to attract new customers, you might hurt your existing ones because they won’t get enough value from your service at a low cost.

On the other hand, if you raise prices to retain current customers you may miss out on potential sales opportunities due to increased costs.

Differences between ACV & ARPU

There are some key differences between ACV and ARPU. The former represents the total amount paid over the course of a year while the latter shows only the average amount received during the same period. Both metrics are useful, but they serve different purposes.

Both ACV and ARPU can offer valuable insights into the financial health of a company or organization.

For example, ACV helps you determine whether the overall cost of operating a service is reasonable compared to its revenues. On the other hand, ARPU provides insight into the efficiency of marketing strategies.

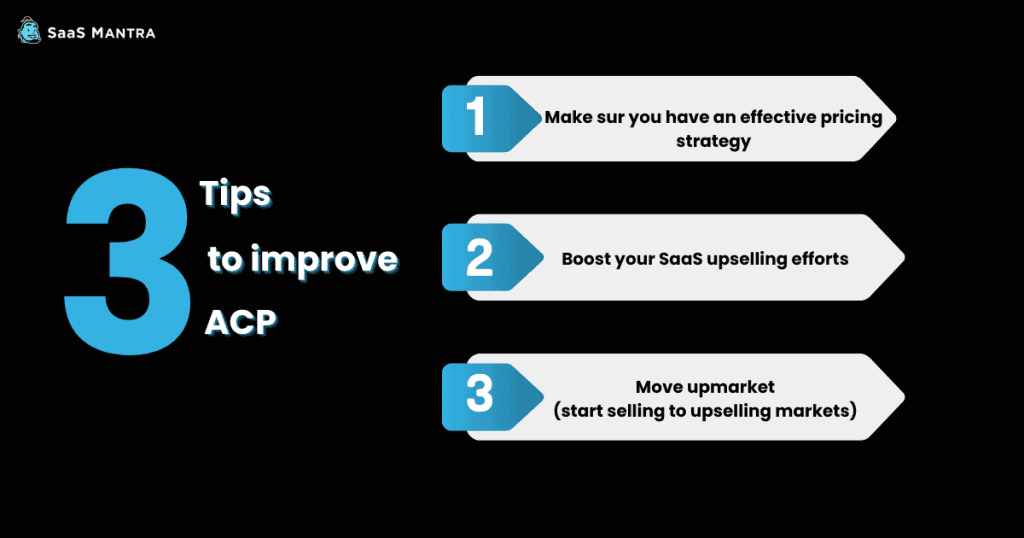

How to improve Annual Contract Value:

Improved ACV is a good sign of growth!

If you are generating more revenue per contract each year, it indicates that your business is growing.

So how do you get there? Here are a few tips👇

1. Make sure you have an effective pricing strategy

Pricing your SaaS products is an essential part of running a successful business. Especially for SaaS startups, knowing how to set prices correctly is crucial.

Pricing determines the amount of profit per unit sold. The two main approaches to setting prices include value-based pricing (VBP) and cost-plus pricing (CP).

VBP focuses on finding the correct price point for each item and aligning them with consumer values.

CP focuses on selling at a higher price because the costs involved are lower. In other words, the margin between the price and the actual production cost is greater under CP than VBP.

There are several benefits to using a VBP approach:

First, it helps customers understand their true buying power and allows sellers to create long-term relationships with customers.

Second, consumers value items highly when they have good experiences with those items.

Third, when prices increase, sales decrease.

Fourth, when prices fall, sales increase.

Fifth, customers are happy when they get a discount. Finally, VBP leads to increased profits.

2. Boost your SaaS upselling efforts

Upselling is a great way to increase revenue without increasing costs. If you are using a SaaS solution, you should consider offering additional add-ons or upgrades. This practice increases conversion rates and boosts sales.

Upselling refers to selling additional services or products after a customer has already purchased from you.

It is considered a very effective sales technique because it makes customers feel valued and keeps them coming back for more.

There are two main ways to upsell your current SaaS product:

1️⃣ Lead Scoring

2️⃣ Automated Upsell Messages

3. Move upmarket (start selling to enterprise markets)

Upselling from one market segment to another is the process of moving upmarket.

Moving upmarket can seem daunting at first. There are lots of things to consider, from design to pricing to marketing. Instead, take these steps to move upmarket successfully.

Your customers want high-quality service. They expect that you will provide excellent customer support, deliver top-notch quality, and offer special discounts or promotions for loyal customers. These are all signs that you have moved upmarket.

There are three ways to move upmarket (and avoid falling back down):

🔸 Offer superior customer service,

🔸 Focus on quality, and

🔸 Give your customers reasons to stay loyal

Growing your SaaS product is no easy task. You need to remember that it is not just another new market you have been selling to for years.

You have to do some homework and research what big brands want and need. You’re going to need a new ideal customer profile (ICP) and buyer persona.

Bigger companies often have different requirements and expectations than smaller ones. They are also more risk-aversive, so they will be more cautious about which products they invest in.

This is why it is so important to have a strong go-to-marketing strategy in place before you begin marketing to enterprise customers.

Wrapping up

One of the most important things for a SaaS company to measure is its annual contract value (ACV). It not only enables you to assess how much money you are making from a particular customer, but it can also help you determine how profitable that contract is.

On its own, annual contract value doesn’t tell much of a story. It would be best used in conjunction with metrics like ARR, ARPU, and CAC.

Also keep an eye out for other important SaaS KPIs such as the lifetime value per value (LTV) & customer acquisition cost (CAC) ratio, net promoter score, net revenue retention (NRR), and more.