Top 7 Fund-Raising Ideas for Your Bootstrapped SaaS Start-up

You could be a SaaS Start-up founder building a SaaS tool with the minimal resources you could find.

The best part is that it works, and it solves a critical pain point for your users.

But being a SaaS entrepreneur also means you are responsible for developing it further and growing your business.

Like every other SaaS Start-up, or business for that matter, you need capital.

SaaS Market is already highly volatile and disruptive. It is only a matter of time until a competitor comes up with a better SaaS Tool to replace yours.

You need to get ahead of any potential competitors to sustain your SaaS business and grow with the industry.

How can you grow your company when you’re running low on funds?

Time is very critical for success. You need to raise money fast to grow your SaaS Start-up. It is because a new competitor is not the only challenge in growing a SaaS Start-up.

Here are the most common challenges in scaling your SaaS Start-up before the different fund-raising ideas for your SaaS Start-up.

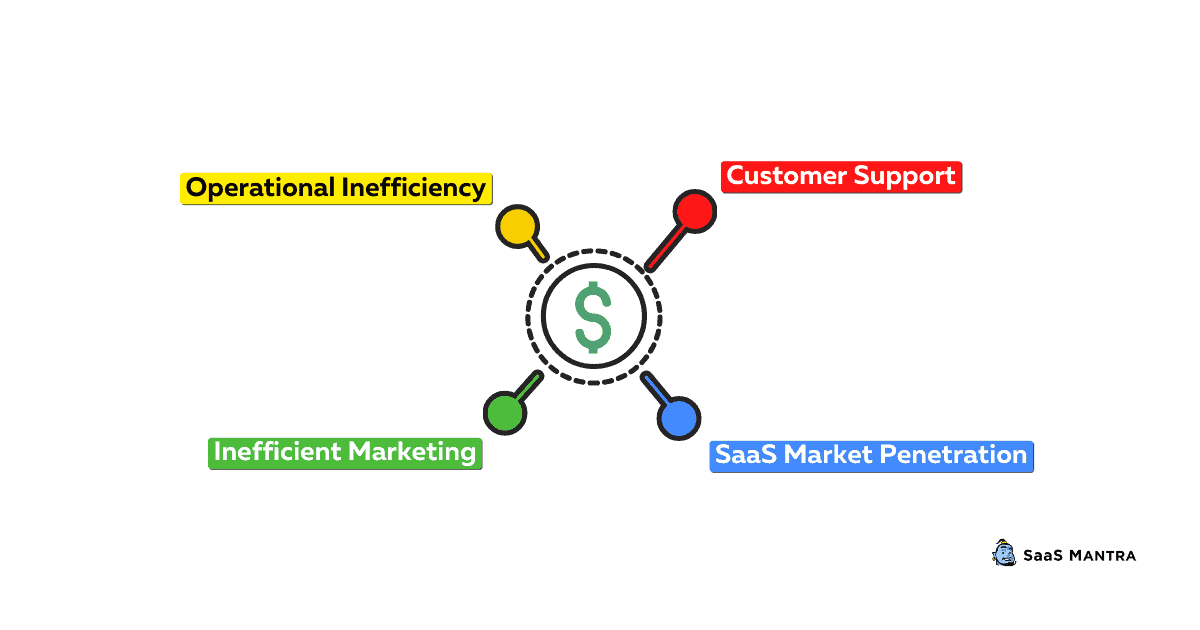

Common Challenges for a Bootstrapped SaaS Start-up

Start-up companies lack many things, challenges are not one. And SaaS Start-up companies are no exception.

Every SaaS Start-up faces these challenges, which are manageable for you when you have sufficient funding.

1. Operational Inefficiency

Operational inefficiency is not specific to SaaS companies alone. Yet, it is one of the most common challenges for SaaS Start-up companies since they are very young.

Operational inefficiency affects the stability of your SaaS company. It often results in delayed and abandoned projects.

And more importantly, it drastically reduces the ROI.

Efficient administration can help you overcome this challenge. However, if you lack the minimum required resources or depend on improper tools and technology, it can stunt your growth.

Raising sufficient funds for proper business operations can help you solve this problem for your company.

2. Customer Support Handling

Customer support is a big challenge for any SaaS Start-up company.

When you launch your first version of your SaaS tool, you will receive useful feedback from users. Feedbacks are useful. But more than that, customer support is an excellent opportunity to build a strong customer relationship in the long term.

It helps you establish a strong brand image and acquire new customers via your existing ones.

The challenge is that in the early stages, your product will be less than perfect. And it is supposed to be less than perfect.

Your SaaS could have minor bugs, it may require new features. Or a simpler design for your product.

All these things come from your initial users. And in the early stages, there could be too many queries to handle.

It’s hard to keep track of all those issues unless you have a strong customer support team.

3. Inefficient Marketing Practices

Marketing is another major challenge for SaaS Start-Up founders.

Most SaaS Start-up companies fall behind in reaching the right audience for their product.

Moreover, even the very few qualified leads they reach do not convert because of poor sales practices.

It is common for many SaaS Start-up companies, despite creating an excellent product. It is also one of the reasons why an average SaaS product becomes successful compared to an excellent one.

4. SaaS Market Penetration

If you want to succeed in the SaaS market, you need to penetrate the market.

There are thousands of SaaS tools available today. And every one of them is competing for visibility.

If you are a developer cum entrepreneur, you may find it even harder to bring in users to your SaaS tool. Limited exposure, can stunt your SaaS Start-up growth in several ways.

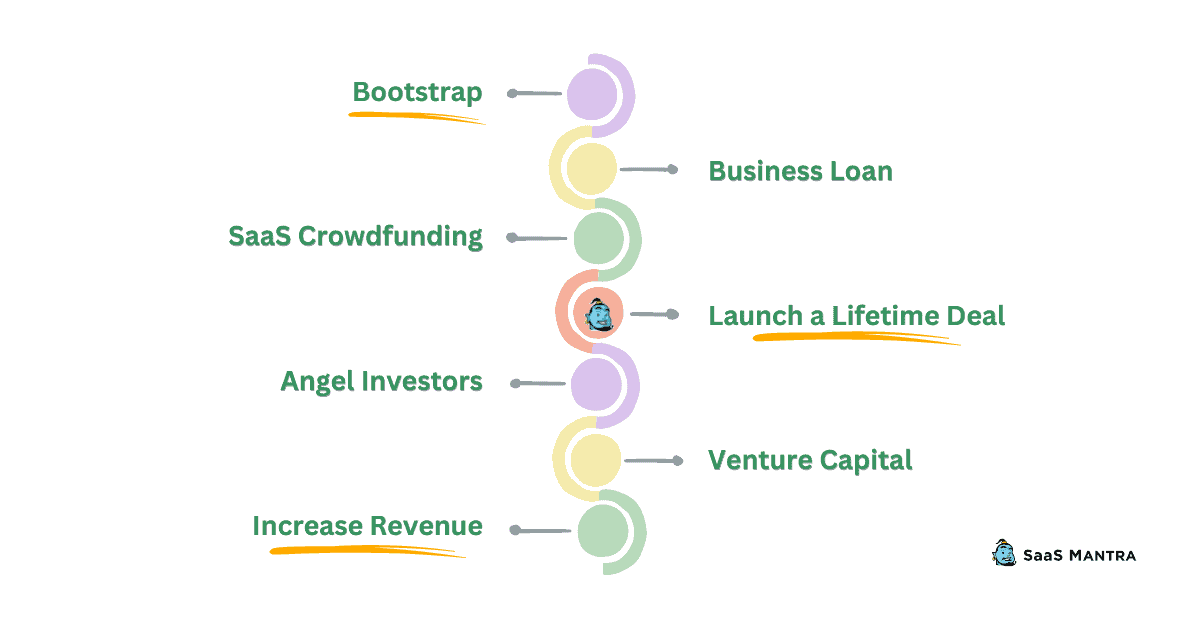

Top Fund-Raising Ideas for Your SaaS Start-up

Insufficient funds can push your SaaS Start-up into bottleneck situations.

No SaaS entrepreneur wants to watch their company burn up because of insufficient funds, especially after creating a great product.

Here are different ways you can raise funds for your SaaS Start-up.

1. Self-Financing

Self-financing is the easiest way to start a SaaS Start-up.

You can use your personal savings or credit cards to fund your SaaS Start-up.

It is one of the most preferred and comfortable options by most SaaS founders. By self-financing your Start-up, you ensure the operational independence of your SaaS Start-up.

It allows you (and your co-founders) to be the sole decision-makers for your SaaS company.

However, self-funding is risky because you may run out of money before you reach your goal.

2. Taking a Business Loan

Taking a business loan is a good option for SaaS Start-up companies.

You can get funds more than sufficient to last a year or more. And you also get an extended period to not worry about repayment and focus on building your company.

Moreover, business loans come with lower interest rates and flexible repayment terms.

The only challenge is satisfying the lender’s qualification factors.

Your business loan qualification may depend on your credit score, Tax returns, Business license, registration, and other legal documents.

3. SaaS Crowdfunding

Crowdfunding is a new concept in the world of start-ups.

It allows entrepreneurs to raise money by selling shares in their businesses. The investors who buy shares in your Start-up get equity in return.

The advantage of crowdfunding is that it doesn’t require collateral. It is easy to set up.

And it has become popular among SaaS Start-up.

The disadvantage of crowdfunding is that it takes longer to raise capital.

Also, there is no guarantee that you will get the amount of money you need.

This method works well for early-stage Start-up.

4. Venture Capital

Venture capitalists invest in promising Start-up companies. They provide seed funding to help Start-up companies start and grow.

Venture capitalists usually invest in young Start-up. They expect high growth potential and a strong team behind the product.

Venture capitalists typically invest between $100,000-$500,000 per round. They offer higher amounts when they see a great deal of traction.

They also offer mentorship and guidance to help Start-up grow.

5. Angel Investors

Angel investors are individuals who invest in Start-up. They typically invest small amounts of money in Start-up.

Angel investors often have experience in investing. They know how to evaluate Start-up and make decisions based on their evaluation.

Angel investors are willing to take risks and work closely with the founder(s).

Some angel investors specialize in investing in certain types of Start-up companies. If you are fortunate enough, you may find an angel investor interested in software and SaaS business.

6. Increase Business Revenue

Increasing business revenue with profit is one of the most dependable ways of raising funds for your SaaS company.

However, it requires rigorous marketing and sales practices. Moreover, even with excellent YoY profit, you raising funds from business profit alone can take years.

SaaS, being a highly disruptive market, can take you by surprise if you’re growth rate falls short.

7. Launch a Lifetime Deal to raise funds

Launching a lifetime deal is another way to raise funds for your SaaS start-up.

A lifetime deal is a long-term contract where a user pays a fixed price for a lifetime license of your tool. And even though it is a lifetime deal, most users are not everyday SaaS users.

It allows you to raise the necessary funds quickly without increasing your operational cost. Yet, fundraising for your SaaS Start-up is only one of the several benefits of launching a Lifetime SaaS Deal.

It can give your SaaS Start-up a great exposure and reach more fresh audience in a short time. Many SaaS Start-up companies intending to scale their business launch a SaaS Lifetime Deal to trigger growth.

However, when launching a lifetime SaaS deal, you need to evaluate the SaaS Marketplace carefully.

Conclusion

Raising funds for your SaaS start-up is not as difficult as many people think. You need to be creative and resourceful.

Even though there are several ways to raise funds, not every way works for SaaS companies.

Especially if you are a Start-up company your options are limited. Yet some of these are very flexible, like finding an angel investor or launching a Lifetime Deal.

You should consider all options available to you before deciding which option to choose.

And at all times, do not compromise on your long-term values and independence for short-term fund requirements.